The Swiss Financial Services Act (FinSA/LSFin) entered into force in January 2020. This is a new financial law in Switzerland aims to:

- define a code of conduct for the provision of financial services and financial instruments,

- create fair competition conditions amongst financial services providers,

- as well as to enhance protection for investors.

The FinSA/LSFin has significant impact on financial services providers’ duties relating to the offer of financial services and the distribution of financial instruments to their clients. In particular, financial services providers are now obliged to:

- Segment their clients into three categories: private, professional or institutional categories.

- Know their risk profile

- Apply the appropriate code of conduct

Now more than ever, understanding the FinSA/LSFin is a key element of compliance for any Swiss bank or Swiss financial services provider.

Our E-Learning programme

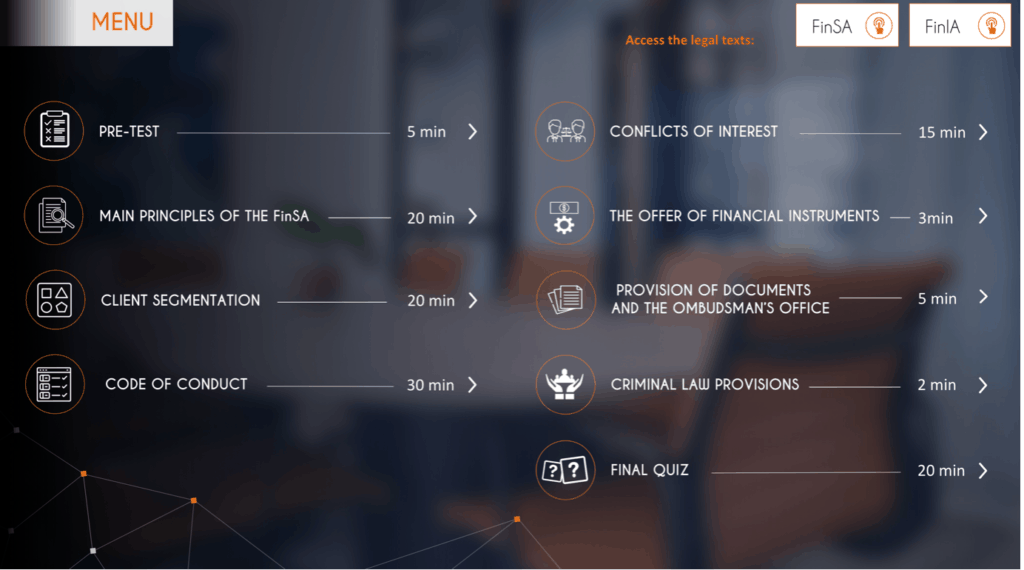

We responded quickly to the demands and changes of the financial regulatory landscape. In 2020, eSkills worked with CoFaktory, one of the best regulatory experts in Switzerland to design an e-learning programme specially catered to helping financial services providers navigate the new rules and regulations of the FinSA/LSFin.

This training is aimed at client advisors of Swiss financial institutions and client advisors of foreign institutions, who are serving clients in Switzerland.

Our course covers a comprehensive list of subjects, including:

- Classify customers according to the main principles of FinSA/ LSFin

- Distinguish the principles and objectives of FinSA/ LSFin classification.

- Apply the rules of behavior in the provision of financial services to clients.

- Know and comply with the “Best Execution” rules and FinSA/LSFin organizational rules.

- Validate their skills through a certification test.

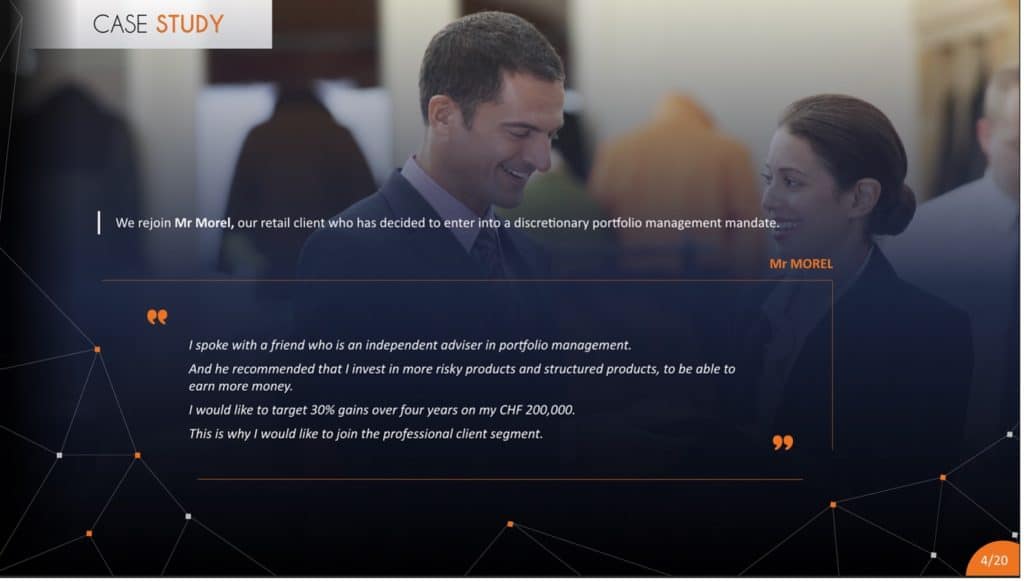

Course Feature: Interactive Case Studies

Nobody likes sitting through a boring e-learning course just with tons of text and legal jargon!

That is why we spent tremendous effort in designing well-thought out case studies, each detailing realistic scenarios potentially faced by financial services professionals in their course of work. The main objective is to allow them to immerse in the different scenarios and to familiarize themselves with how they should respond to ensure compliance towards the FinSA/LSFin.

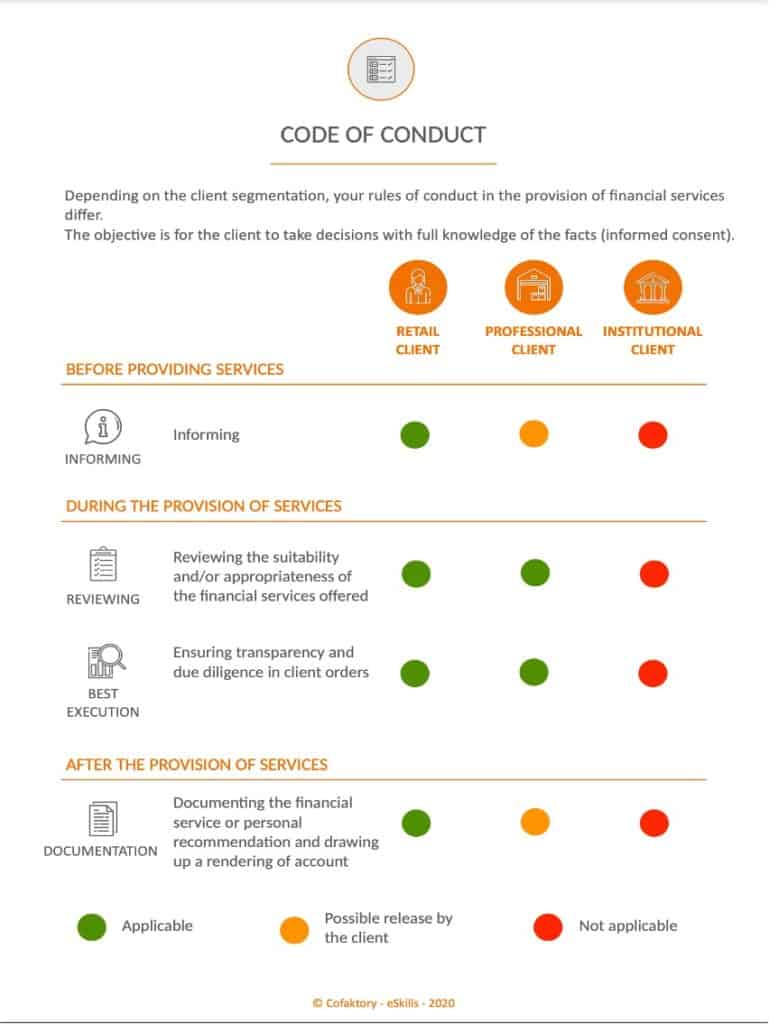

Course Feature: Downloadable Info Guides

On top of that, learners can download informative guides and checklists on information related to client segmentation, code of conduct and client risk profile forms. These are downloadable and learners can refer to and apply them instantly in their course of work.

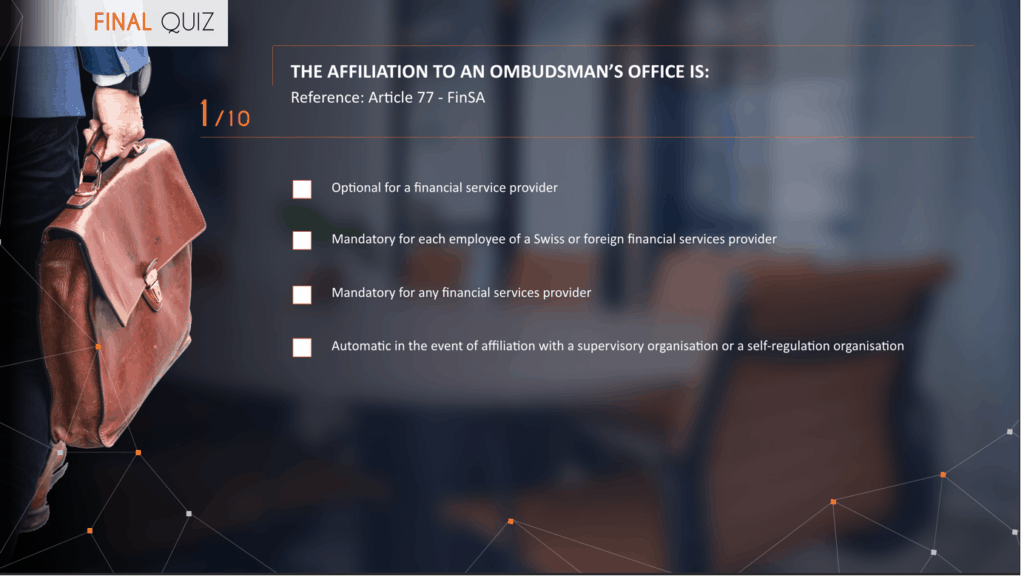

Course Feature: Formal Assessment

At the end of the course, there is also a formal assessment consisting of 10 questions with a passing grade of 70%. This serves as a benchmark for learners to test their knowledge of the regulations under the LSFin SA.

Course Feature: Language Options in English and French

Multi-lingual workforce? No problem! Our FinSA e-learning course is available in both English and French.

Our programmes are flexible and fully customizable: allowing you to mould a learning experience that works for you! For example, it is possible to integrate your own customer profile analysis form and your regulatory specificities.

To see our broad offering of compliance training for financial institutions, take a look at our course catalogue.

Would you like to incorporate the LSFin e-learning course as part of your financial institution’s corporate trainings?

Talk to us today! hello@eskills.ch